Michael M. Santiago/Getty Images News

Dealerships are widely understood and have been shunned by many investors. This is despite the average dealership having good underlying economics. Asbury Automotive Group Inc. (ABG) is one of the winners of this favorable market, which has undergone consolidation in the last 60 years. The company’s embrace of ecommerce puts it in a strong position to win an increasingly digital-first world. The company’s real estate portfolio gives it downside protection and is a plus as dealers adapt to ecommerce. The chain remains significantly undervalued against the market.

What Asbury Does

Asbury owns auto dealerships across the country. According to the company’s 2020 annual report, as of December 31, 2020, Asbury owned and operated 112 new vehicle franchises, selling 31 different car brands in 91 dealership locations, 25 collision centers, and one auto auction in 16 cities in nine states. The company sells a wide range of car products and services, such as new and used cars; parts and service or “P&S”; and finance and insurance products (“F&I”).

Dealerships Operate in a Favorable Industry

Industry dynamics matter. It is important to look for businesses whose average characteristics are favorable, rather than to try and find great businesses in terrible industries. Since vehicle sales collapsed in the wake of the 2008 recession, the automotive dealership industry has steadily improved its profitability.

According to the National Automobile Dealers Association (“NADA”), the average return on equity of automobile dealers for the year to date in October 2021, was 47.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, compared to 31.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} for the same period in the year prior.

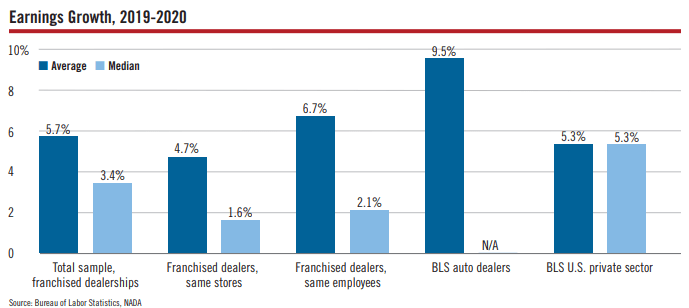

NADA’s Data 2021 report shows the degree to which dealerships thrived between 2019 and 2020, despite, or perhaps because of the pandemic:

Source: Data 2021

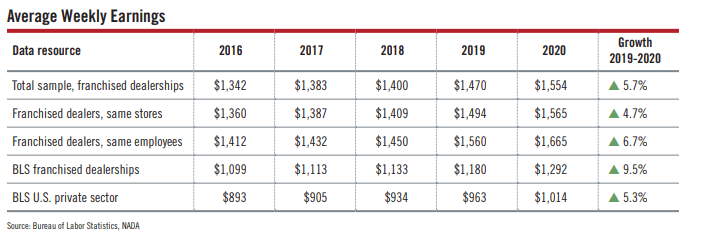

The report also shows, however, that this trend of earnings growth predates the pandemic. The chart below shows that the average weekly earnings of automotive dealerships have been rising since at least 2016:

Source: Data 2021

I am not the first one to notice this. When Berkshire Hathaway bought the Van Tuyl Group in 2014, Amy Wilson of Automotive News reported that,

“In 2013, the average U.S. dealership produced a return on equity of 29 percent, according to the National Automobile Dealers Association. That figure has risen in four of the past five years and is now more than double the 12 percent return recorded in 2008 when U.S. vehicle sales collapsed.”

There are obvious reasons why dealerships have such favorable economics. At the micro level, the business model makes it difficult to not be profitable. A dealership does not require a lot of invested capital, and dealerships can scale their volumes and earn high returns on capital despite having very thin margins.

Returns have improved partly because the number of dealerships has tumbled over the decades, from over 30,000 almost 60 years ago, to around 16,700 today. This reduction has occurred despite the number of automobiles on the market rising along with the population. Consequently, the average dealer can push through more vehicles today than was possible 60 years ago. With industry consolidation and an already asset-light business model, the average dealership can enjoy rising profitability.

I expect that the global supply chain disruption will lead to further consolidation. Many dealers have struggled to get automobiles, with consumers having to go great lengths to obtain cars. Dealers have suffered from very low inventories, emphasizing the importance of being a large dealer for securing inventories. The supply chain disruption is unlikely to end soon and the Ukrainian crisis has probably lengthened it. That means priority will be given to national chains over small chains, driving industry consolidation. For small dealers, that is a tragedy. For large dealers, that will improve returns.

Asbury’s Real Estate Portfolio Gives It Downside Protection

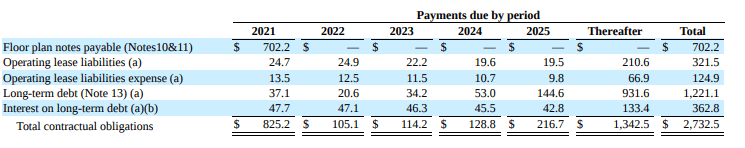

Retailers typically do not own much of the land that their businesses operate from, resulting in large operating lease expenses. Asbury, like many automotive dealerships, is different. The group owns the majority of the real estate its dealership operates from, resulting in low operating lease expenses. An example of the company’s low operating lease expense is shown below:

Source: 2020 Annual Report

Consequently, the business has significant downside protection in the event that its automotive dealerships were to prove uneconomical: they could sell portions of their real estate portfolio, or convert their use. Although investors typically see Asbury’s purely as an automotive dealer, the company itself thinks in terms of its “dealership and real estate portfolio”.

Ecommerce disruption will show the importance of owning real estate, as Asbury will be able to convert dealer locations into delivery centers where consumers collect vehicles bought online. Retooling real estate can work in a number of ways, but fundamentally, Asbury has optionality through ownership.

Asbury’s Profitability Leads Its Peers

The company’s gross margins are industry-leading. Asbury enjoys the highest 5-year gross margin and the second highest 5-year returns on invested capital (ROIC) in the industry. Overall, the company’s gross margins and ROIC are higher than peer-average (Source: Company Filings):

|

Ticker |

5-year Gross Margin |

5-Year ROIC |

|

|

Asbury |

ABG |

16.55{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

11.17{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

AutoNation |

AN |

16.55{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

7.94{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

Lithia Motors Inc. |

LAD |

9.06{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

15.86{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

Group 1 Automotive |

GPI |

15.32{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

7.67{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

Penske Automotive Group |

PAG |

15.32{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

7.65{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

Sonic Automotive |

SAH |

14.62{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

5.84{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

Peer Average |

14.57{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

8.28{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

If the company achieves its 5-year target of 20{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} revenue growth compounded across 5 years, it will be able to widen its lead over its peers. The company believes that it can achieve this target by increasing same store revenues by $2 billion, increasing revenue from Clicklane to $5 billion. Between 2018 and the trailing twelve months (“TTM”), Asbury grew revenue from $6.87 billion to $9.42 billion, compounded at 8.42{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}. Yet, the company’s 2021 results suggest that the company’s targets may be within reach. Revenue was up 38{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, while gross profit rose 55{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} compared to 2020.

If margins fall to the industry average, the company could generate earnings per share (“EPS”) in the low-30s, and if they can maintain their margins, that looks more like the low-40s.

Clicklane Gives Asbury a Competitive Advantage

As the Wall Street Journal noted, car dealerships have changed significantly since the start of the pandemic. Although online sales predate the pandemic, since the pandemic, online sales have shot up. More and more Americans are buying vehicles online, making car dealerships look more and more like those other parts of the retail industry disrupted by ecommerce. Asbury is ready for this.

In 2020, Asbury introduced its new communications technology ecosystem, Clicklane. Clicklane allows customers to buy or lease both new and used cars online. Clicklane was unrolled across the nation, with implementation being completed in Q1 2021. The platform is part of the company’s attempt to improve the customer experience and increase its digital footprint.

Asbury’s peers have not been able to match its ability to sell new cars online. This gives it an edge over Carvana, Shift and Vroom who sell used-cars. Carvana, Shift and Vroom still represent a small portion of the used-car market, but they show what the future could look like. Like Clicklane, they can sell used cars online without restrictive franchise laws which prevent new car sales. Clicklane is able to also succeed with new car sales given its franchise agreements with original equipment manufacturers (“OEMs”). It does so by ramping up its footprint within a geography to maximize its ability to push volumes, all the while taking market share from smaller dealers.

Clicklane will allow Asbury to capture a different kind of customer, and to expand its drive for new customers to a new front. This omnichannel approach should have a positive effect on its revenue growth.

The shift to digital will lead to further industry consolidation. Small chains will not be able to match the ability of Asbury and other chains to offer both new and used cars online. Secondly, even if they can secure franchise agreements with OEMs, brands will become more important than ever. In the past, location was everything, but in a more digital world, small dealers who thrived because they were in strategic locations will see less traffic as consumers take to the internet first.

The dealership value chain is likely to change. As we noted above, the dealership market is likely to skew toward national chains as OEMs and sellers prioritize national chains over smaller chains. Ecommerce will reduce the need for inventory, but this will not help small chains: online, brands are everything, and network effects come into play. Although companies like Tesla and Rivian have embraced a dealer-free model and want to sell directly to customers in all states, customers will still need dealer platforms as a hub to view multiple types of cars. Ecommerce has shown that direct-to-customer models will not replace intermediaries like dealers.

Could Lithia Be a Fit?

Although Lithia has a higher 5-year ROIC and has many of the same features as Asbury, one important thing to note is that the two companies do not have much overlap. Thus, Asbury does not have to worry about Lithia using its superior ROIC to drive its profitability down. Indeed, it is notable that the two companies are very similar, despite little geographic and brand overlap. This suggests to me that both companies could viably merge, consolidating the industry further.

Lithia has aggressively bought up dealers with a view of having a Lithia dealership within 100 miles of every vehicle shopper. It would be interesting to see if that translates into a move for Asbury, which would be a natural fit. Under current antitrust sentiment, that deal may be hard to push through. However, we have to note that Asbury’s most competent and complete potential competitor doesn’t really compete in the same space as Asbury.

Valuation

On a relative basis, the company has a price-earnings (“PE”) ratio of 6.91 and a 5-year PE ratio of 9.47. This is typical of dealerships, which have had low valuations for many years. Investors have simply not understood dealerships and their powerful industry dynamics. Consequently, like many of its peers, the company is cheaper than the market, which trades at a multiple of 24.46.

Conclusion

Asbury operates in an industry that has undergone consolidation even as the number of cars sold and the country’s population has risen. In addition, the global supply chain disruption is likely to accelerate consolidation further. As a result, the average dealer is going to see more volumes and even greater profitability. Asbury’s is one of the best run and most profitable dealers. Clicklane gives it an advantage in an industry where ecommerce is becoming a more important part of how customers buy their vehicles. The company’s relative cheapness combined with industry dynamics make this a very attractive stock.