Dmytro Skrypnykov/iStock via Getty Images

The following segment was excerpted from this fund letter.

Autohellas is an automotive rental and distribution group located in Greece and the Balkans (and is in the process of buying Hertz’s rental business in Portugal). Autohellas has a fleet of 47,100 rental cars with 111 rental locations, 10 parts distribution locations, and 22 dealership locations in eight countries. The rental business has two segments—short-term rentals and long-tern rentals/leases/fleet management. Autohellas has the Hertz franchise in Greece, the Balkans, and Ukraine. As a franchisee, Autohellas has access to Hertz’s reservation system and can use the Hertz name and know-how in the countries in which it operates. Autohellas’s growth in a given country begins by entering via car rentals, primarily at airports. Once a rental fleet is established in a country, a used car sales operation (branded Stock-Center) to sell off lease/rental autos is typically opened. Finally, in some countries (Greece and Bulgaria), distributorships/dealerships are purchased or formed. Thus, automobile rental firms can have up to five businesses in one. These include: rentals, new car sales, used car sales, service and parts, and financing and insurance. Each of these businesses requires a fixed base of costs in each country; thus there is a minimum scale required to reach profitability. Once these fixed costs are covered by one function (let’s say rentals), adding additional services like used car sales and distribution have large incremental margins.

Autohellas has five levers for cash flow growth: (1) entering a new rental market; (2) distributing new cars or parts within a country; (3) entering auto or parts distribution in an existing rental country; (4) paying down debt; and (5) distributing excess cash as dividends or buying back shares. Autohellas was founded by an entrepreneur, Theodoros Vassilakis, who opened a Hertz car rental franchise in Crete in 1966 with six VW Beetles. In 1974, Autohellas bought out the Hertz franchises in the rest of Greece. In 1999, Autohellas went public via an IPO in Greece. From 2003 to 2016, Hertz expanded buy buying or opening new rental locations primarily in Bulgaria, Cyprus, Romania, Serbia, Montenegro, Ukraine, and Croatia. In 2003, when Autohellas purchased the Bulgarian Hertz franchise, it also became the exclusive distributor of SEAT automobiles in Bulgaria. In 2005, Autohellas formed a joint venture, Eltrekka, a Greek spare parts distributor. In 2007, before the GFC, Autohellas distributed via a return on capital and dividends equal to 28{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of its then market capitalization. In 2008, Autohellas formed Autotechnica, a Greek vehicle management, maintenance, and bodywork firm to service its Greek rental fleet. In 2015, Autohellas purchased its Greek auto dealership Velmar and became the exclusive distributor of SEAT automobiles in Greece. In 2017, Autohellas became the exclusive Greek distributor for Hyundai and Kia automobiles. In 2022, Autohellas purchased the Hertz franchise in Portugal and was in the process of buying the exclusive distributor rights for Stellantis automobiles in Greece.

The entrepreneur who founded Autohellas, Theodoros Vassilakis, also founded Aegean Airlines in 1999. Aegean Airlines subsequently purchased the Greek state airline Olympic and today is the largest Greek airline. Autohellas owns 11.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of Aegean Airlines. In addition, Autohellas has a travel partnership with Aegean Airlines which provides auto rental referrals from Aegean passengers.

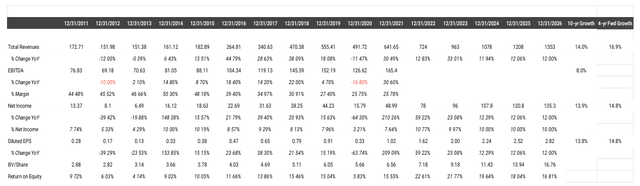

Autohellas began in auto rentals and, over time, has expanded both geographically and functionally into related markets. These actions have generated 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} annual revenue growth and 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} annual EPS growth over the past five to 10 years. Over time, Autohellas’s return on equity has increased from about 10{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in 2015 to over 20{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} currently. The current return on equity is in line with its much larger competitor SIXT.

Autohellas has purchased firms at good prices and turned them around and added new services over time. An example is Velmar, Autohellas’s Greek automobile dealership. Before its purchase by Autohellas, Velmar provided maintenance for some of Autohellas’s Greek auto fleets. Before the purchase in 2015, Velmar generated €87 million in revenue and was break-even. Velmar was purchased for €641,000 in Autohellas stock. Over time, Autohellas has added new distributorships and started a parts distribution JV resulting in €394 million in revenue and €24.1 million in TTM after-tax earnings for 1H 2022.

The short-term auto rental market is being disrupted by new business models and technology. Uber and Lyft have provided an alternative to short-term leases for travelers who have limited travel requirements on trips. However, it is uncertain if this will materially reduce rental car demand, as the use cases do have some overlap but are also distinct. Autohellas and other rental firms utilize the internet for reservations and operations, so it has actually enhanced incumbent rental firms versus new start-ups.

The mix of long-term vs. short-term rentals in 2021 for Autohellas was 45{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} for long-term leases and 55{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} for short-term leases in Greece, and 58{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} and 42{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} outside Greece. Short-term leases are driven by both corporate and personal travel, while long-term rentals are driven by local corporate demand. Electric vehicles (EVs) are being integrated into Autohellas’s fleet. Autohellas has also opened a Kineo location in Athens to rent small transportation vehicles like bikes and scooters.

The car rental model is also subject to local economies of scale. In a local market, a car rental and distribution business, like other retailers, can take advantage of economies of scale (density) associated with advertising, logistics, customer acquisition, and local oversight.

Car Rental and Dealership Business

In Greece, Autohellas has a market share of about 11{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of the short-term rental market (12,000 cars) and 18{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of the long-term rental market (26,500 cars). The total short-term leasing market includes 100,000 cars with the five largest franchised rental firms having 30,000 cars and the remaining firms (70{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of the market) having less than 2,000 cars per firm. Thus, the short-term rental market is very fragmented. The long-term rental market is more consolidated with the top three firms having about 75{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of the market, or 100,000 cars.

In other markets, Autohellas has a smaller—but growing—market share. The largest auto rental firm in Europe is SIXT. Internationally, the car rental business has consolidated into five large players (Enterprise, Hertz Global, Avis, Europcar, and SIXT) and smaller regional players like Autohellas. This consolidation and recent bankruptcies of Hertz and Avis have led to rationale pricing.

The overall Greek car dealership market is still recovering from recession/depression levels versus the pre-2008 automobile car market. In the late 1990s, Greece purchased about 150k cars per year. From 1999 to 2008, Greece purchased 250k to 300k cars per year. As a result of the GFC and the subsequent Greek crisis, car purchases declined to 50k per year by 2012. Since then, Greek car sales have increased to about 120k cars per year. Given the historical sales level, there is the potential of significant growth once the Greek economy fully recovers.

One source of earnings for rental businesses is the investing/trading of leased assets—in this case autos.

Autohellas sells about 5,000 to 6,000 fleet vehicles per year and generates €10 to €15 million of gains on sale earnings per year. The firm buys new automobiles and gets a discount on the purchase of these vehicles, leases them over a given period of time, and sells them for a residual value. Some firms sign buy- back agreements when they purchase vehicles (SIXT) and others (like Autohellas) assume the residual risk and can receive the return for assuming this risk. Autohellas’s average fleet vehicle’s life cycle is three to five years.

Sources of growth for Autohellas include geographic expansion of rental car and used car sales franchises, expansion of automobile dealership/distribution franchises, the recovery of the Greek automobile market, and tourism growth in Autohellas’s rental footprints of Greece, Portugal, and the Balkans.

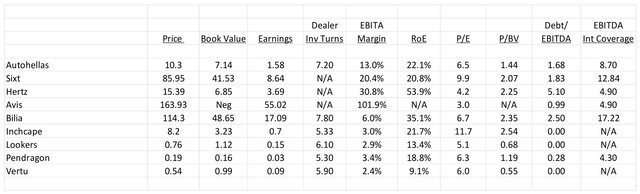

Autohellas’s dealer group has utilized the local scale model to generate higher margins than (5.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} EBITA) and comparable inventory turns to (7.2x) comparable but larger European automotive dealers (Bilia, Pendragon, Inchcape, Vertu, and Lookers). The higher margins are, in part, due to the clustering of dealerships in geographic locations. Autohellas dealer group also has a steady flow of maintenance business from its Greek rental fleet. Inventory turns are also important in the auto retailing business. Autohellas has one of the highest inventory turns of 7.2 times per year amongst the European car dealers, which range from 5.3 to 7.8 times per year. Quicker inventory turns mean that the dealer is matching the customers to cars more quickly than its competitors. This ability allows Autohellas dealer group to either sell fewer cars than competitors or to lower prices and obtain the same return on invested capital. Autohellas dealer group has the highest returns on equity (40{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in 2021) relative to European dealer comparables from both higher margins and inventory turns.

Downside Protection

Auto rental/leasing firm risks include both operational leverage and financial leverage. Operational leverage in the rental/leasing market is based upon the size of the rental fleet at any given time and the scale versus demand volume of local operations. The rental/leasing firms always have the option of buying and selling used cars, so the timing of these purchases/sales can add to the bottom line. Over the past few years, Autohellas’s fleet has grown to 49,000. Autohellas has historically sold about 10{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of the TBV of its fleet per year. Management has also generated significant gains on sales for these transactions of about 30{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of pre-tax profit over the past five years. Some other major competitors (SIXT) have auto buy-back agreements which reduce the risk and reward of these auto sales transactions.

Financial leverage can be measured by the debt/EBITDA ratio. Autohellas has below-average net debt/EBITDA versus other European rental firms (such as SIXT) of 1.7 and versus Autohellas’s history. This is one of the reasons for the €48.6 million (€1/share) capital return to shareholders this year. During COVID, Autohellas performed well versus SIXT, with a 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} EBITDA decline versus a 60{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} decline for SIXT. Autohellas’s EBITDA has exceeded pre-COVID levels in 2021, while SIXT’s EBITDA is yet to recover to pre-COVID level. The history and projected financial performance for Autohellas is illustrated below.

Management and Incentives

Autohellas’s management has been awarded/purchased new rental franchises or dealership franchises when the right franchise was available at the right price, partially financed by debt, paid down debt, returned capital via dividends when there was excess capital, and invested in and sold its fleet assets when the time was right.

The CEO and his family currently hold 29.2 million shares (€300.8 million), which is more than 15 times his family’s (himself, his mother, and uncle) 2021 salary and bonus of €1.9 million. The CEO’s compensation is structured €200,000 base pay and up to a €200,000 performance bonus based partially on rental profits before tax. For 2021, the CEO took no performance bonus. The CEO has lower compensation than three other senior executives who are the co-founder, the head of dealership operations, and the head of international rentals. The CEO is also the executive chairman of Aegean Airlines. Autohellas does not grant options.

Valuation

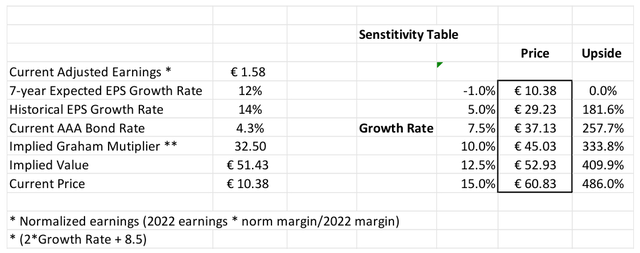

The key to the valuation of Autohellas is the expected growth rate. The current valuation implies an earnings/FCF decline of -1.0{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} into perpetuity using the Graham formula ((8.5 + 2g)). The historical 10- year earnings growth has been 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} per year including acquisitions, and the current return on equity of 23{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}.

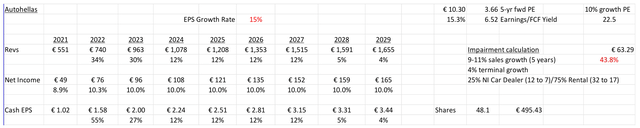

A bottom-up analysis based upon market growth rates of Greek automotive rental/dealer market results was used to estimate an organic growth rate of 12{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} for Autohellas. This is based upon a 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} growth rate for the auto dealer business based upon the revenue growth assumption for the 2021 goodwill impairment, a 10{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} growth rate for the long-term leasing segment based upon unit increases since 2019 including pending orders, and a 5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} growth for the short-term rental business. This does not include any future acquisitions. The auto dealer growth rate includes a partial recovery of the Greek auto market which is down 75{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} from 2008, and the increased market share of Hyundai/Kai in the Greek market which has doubled from 10{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} to 20{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} since 2018. This EPS growth rate is conservative given the historical EPS growth rate of 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} and the current 23{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} return on equity with most of the current earnings being retained. Using a 12{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} expected growth rate, the resulting current multiple is 33x of normalized earnings, while Autohellas trades at an earnings multiple of 6.5x. If we look at the European comparable of SIXT, which is larger but has slower growth prospects, it has an earnings multiple of 10x. If we apply 10x earnings to Autohellas’s estimated FY2023 earnings of €2.00, then we arrive at a value of €20 per share, which is a reasonable short-term target. If we use a 14{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} seven-year growth rate, then we arrive at a value of €51.43 per share. This results in a five-year IRR of 38{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}.

Growth Framework

Another way to look at growth and the valuation of companies is to estimate the EPS five years into the future and see how much of today’s price incorporates this growth. Using the same revenue described above results in a 2026 EPS of €2.81, or 3.7x the current price. If we assume a steady-state growth rate from 2026 on of 5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, then this results in a fair value Graham multiple of 18.5x or €52.2 per share, similar to the five-year-forward valuation above of €51.43 per share.

In addition to the core assets, Autohellas has significant non-operating assets. These include real estate holdings in Greece, including a golf course in Crete, and a 12{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} stake in Aegean Airlines. These assets have an estimated value of about €100 million or €2 per share. These values are based upon either real estate appraisals or the current market price for the Aegean Airline stake.

Comparables and Benchmarking

Below are the European car dealerships and international firms engaged in the car leasing market. Compared to auto rental firms, Autohellas has less debt and better growth prospects and in-line multiples. Compared to European car dealerships, Autohellas has a market that is still in recovery mode, high inventory turns, and is increasing market share along with purchasing more distributorships.

Risks

The primary risks are:

- slower-than-expected market share growth in dealership and rentals;

- lower-than-expected growth in the car market in Greece, as well as tourism growth in Greece; and

- a lack of new investment opportunities (mergers and acquisitions or new dealerships).

Potential Upside/Catalyst

The primary catalysts are:

- higher-than-expected market share growth for car distribution and rentals;

- growth in new markets like Portugal; and

- increased local scale or purchase of local scale in new markets.

Timeline/Investment Horizon

The short-term target is €20 per share, which is almost 95{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} above today’s stock price. If the consolidation thesis plays out over the next five years (with a resulting 15{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} earnings per year growth rate), then a value of €52 (mid-point of the two methods described above) could be realized. This is a 38{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} IRR over the next five years.

DisclaimerThis research does not contain all the information that is material to a prospective investor in the Bonhoeffer Fund, L.P. (the “Fund”). Not an Offer: The information set forth in this letter is being made available to generally describe the philosophies of the Fund. The letter does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services. Such an offer may only be made to accredited investors by means of delivery of a confidential private placement memorandum, or other similar materials that contain a description of material terms relating to such investment. The information published and the opinions expressed herein are provided for informational purposes only. No Advice: Nothing contained herein constitutes financial, legal, tax, or other advice. The Fund makes no representation that the information and opinions expressed herein are accurate, complete or current. The information contained herein is current as of the date hereof but may become outdated or change. Risks: An investment in the Fund is speculative due to a variety of risks and considerations as detailed in the Confidential Private Placement Memorandum of the Fund, and this letter is qualified in its entirety by the more complete information contained therein and in the related subscription materials. No Recommendation: The mention of or reference to specific companies, strategies or instruments in this letter should not be interpreted as a recommendation or opinion that you should make any purchase or sale or participate in any transaction. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.