Paco Ybarra, chief govt of the Institutional Purchasers Group at Citi, mentioned the lender is concentrating on personal cash soon after struggling in financial debt cash markets thanks to its conservative strategy to danger in leveraged finance.

Ybarra presented at the Citi Investor Day on the Institutional Purchasers Team (ICG), which consists of the banking, markets and solutions corporations.

He stated the small business has three interconnected strategic priorities – to accelerate expenditure in services, grow the industrial bank and to increase the expenditure banking and market franchises.

“We are continuing the enhancements we have made in our equities franchise and retaining leadership in set earnings when maintaining a really near eye on returns and funds,” Ybarra additional.

He ongoing that investment banking and markets have scale, create large revenues and strong returns but Citi is persuaded that it can make improvements to its present placement and return.

Financial investment banking earned revenues of $6.6bn in 2021 with a return on frequent fairness of 28{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, and was ranked fourth in credit card debt capital marketplaces and fifth in fairness funds markets.

“We have a robust current market placement throughout all features of our financial investment banking franchise and in latest instances we have enhanced our share in mergers and acquisitions and ECM,” reported Ybarra. “We have experienced to some degree in our DCM franchise due to the fact of our conservative approach to the leveraged finance industry.”

Citi’s system is to obtain share by earning focused investments. The three strategic priorities are to redirect coverage to essential expansion sectors recalibrate the franchise to recognise that private cash and financial sponsors are heading to be massive motorists of banking and to capture the cross-promoting prospects in the Institutional Client Team, primarily with the growth in industrial banking.

Citi has hired 70 running directors in expenditure banking among 2019 and 2021 and adjusted its prolonged-founded industry sectors to replicate the four “super sectors” that are driving transform in the overall economy and exactly where the lender is underweight as opposed to its competition – electronic disruption, wellness and wellness convergence, sustainability and the power changeover.

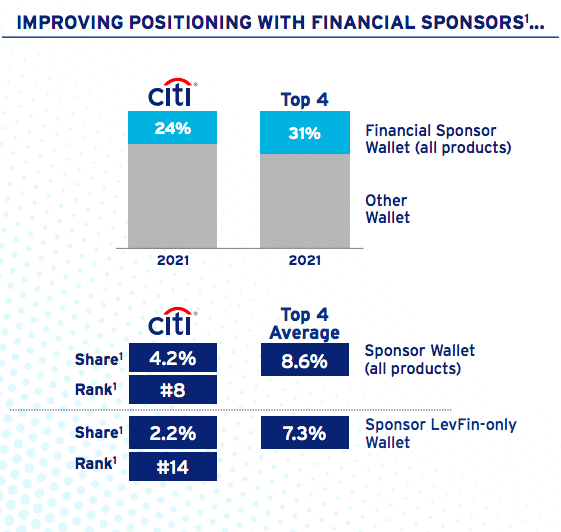

In addition, the financial institution is recalibrating the franchise in recognition of the sizeable change towards personal funds. Ybarra stated Citi’s share with monetary sponsors, and as a result leveraged finance, is disproportionately compact provided its footprint and power in funding, securitization and personal personal debt.

“But our share has deteriorated over the very last couple several years because of a very conservative hazard stance,” he included. “Capitalizing on the non-public asset possibility will have to have us to raise our funds allocation and we imagine we can do that when retaining a prudent tactic to danger.”

Citi thinks that connecting financial investment banking with the rest of ICG and Prosperity Management can provide a multiplier of progress in investment banking revenues.

Markets

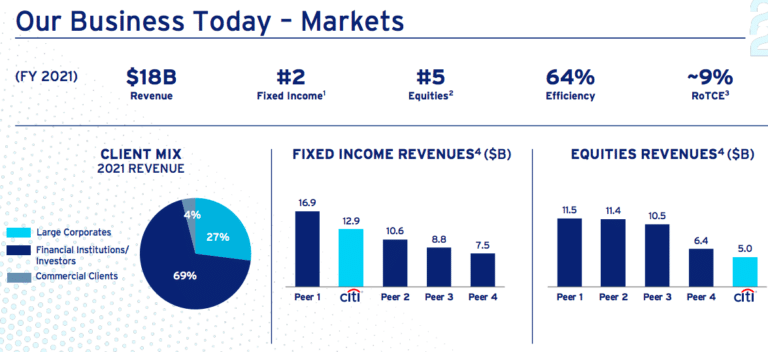

Markets attained revenues of $18bn in 2021 and was rated next in fixed income and fifth in equities, which Ybarra claimed was a major enhancement in recent yrs.

“In latest yrs, we have develop into far more shopper oriented,” he included. “So our revenues are more correlated to exercise and much less to industry route, and consequently are much more secure.”

The bank aims to boost relevance to shoppers and profitability by strengthening capital efficiency focussing on bigger margin businesses and producing its main flow companies a lot more efficient with automation and electronic methods.

Citi would like to increase the ratio of income to risk weighted assets in marketplaces from 4.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} to 5.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} more than the medium expression as a 10 basis stage alter in this ratio corresponds to alter of in between 60 and 70 basis in returns.

Ybarra explained: “Getting to the upper finish is crucial for the enterprise.”

Techniques of reaching this target include focussing on substantial margin actions repricing action producing hedging and distribution abilities and increasing knowledge and analytics to allow for for a lot more intelligent selection generating. As in financial investment banking, Citi needs to raise business enterprise with money sponsors and personal capital asset professionals.

“This produces large options for markets and in particular for a top funding and securitizations business,” added Ybarra.

Citi also aims to rework its circulation firms through electronic investing and getting to be more operationally effective so that trades are processed mechanically and embedded in clients’ workflows.

“We are quite mindful of how automation and connectivity will transform these functions into something akin to where by our products and services corporations are nowadays,” he stated.

Differentiation

Ybarra ongoing that Citi can differentiate by itself by giving a finish established of goods and services throughout 95 nations in an built-in way as a one establishment by managing the customer as one global connection.

“This is the result of a deliberate strategy not to exit products or services that fulfilled main financial requires of our clients,” he included. “This is not easily replicable, and we see our job escalating in worth.”

Huge shoppers are getting to be far more global and mid-dimension consumers are also getting to be world wide sooner, specifically new digital shoppers who are scaling up incredibly swiftly. Just about all, 85{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, of income will come from businesses that have subsidiaries outside the 60 largest international locations and Ybarra argues that Citi is uniquely capable of featuring this protection.