JHVEPhoto

Investment Thesis

Many investors hold Johnson & Johnson (JNJ) because of the company’s well-diversified portfolio, high profitability, excellent balance sheet, and recession-resistant business model. However, JNJ’s diversification into pharmaceuticals, medical devices and healthcare products is not for everyone. Therefore, investors with a solid pharmaceutical portfolio might want to diversify via a medical device company. Medtronic plc (NYSE:MDT) fits this bill very well, in my opinion, in part because the company’s management is very shareholder-friendly, just like JNJ’s. Both companies have decades-long track records of dividend growth. Medtronic caught my attention because of its commitment to diabetes care. With an estimated 537 million patients in 2021, diabetes unfortunately continues to be a mega-market, and the “growth trend” is not likely to abate anytime soon.

In this article, I will discuss the company’s portfolio, focusing on its diabetes franchise, recent growth profile, balance sheet quality, and growth prospects. Finally, I will outline whether I personally would consider investing in Medtronic, taking into account the company’s current valuation.

Company Overview

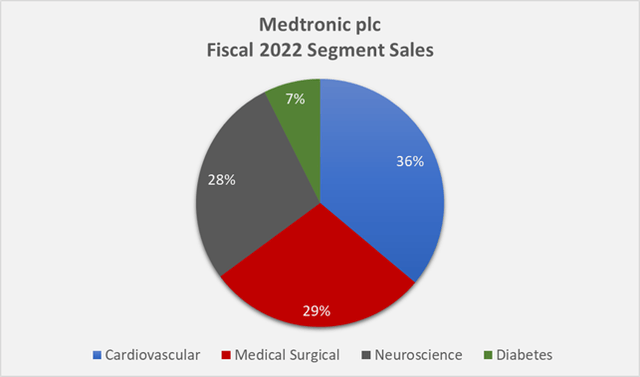

Medtronic is the world’s largest pure-play medical device company with a current (July 21, 2022) market capitalization of $120 billion and an enterprise value of approximately $134 billion. This already tells us that Medtronic is a very moderately leveraged company. Medtronic operates in more than 150 countries and is best known for its pacemakers, insulin pumps, blood glucose monitoring systems, vascular stents and cardiac catheters. Because of the critical role played by many of Medtronic’s products, the company has strong pricing power. Its dominance in many areas is the primary reason for Morningstar’s wide economic moat rating. Medtronic’s portfolio is well diversified both in terms of business segments (Figure 1) and geographically (32{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of fiscal 2022 sales in developed markets outside the U.S., 17{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in emerging markets). Russia and Ukraine contribute only marginally (1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) to Medtronic’s revenue.

Of course, the sectors in which Medtronic operates are relatively competitive, and in terms of diabetes care and pacemakers, names like Abbott Laboratories (ABT) and Boston Scientific (BSX) come to mind.

Figure 1: Medtronic’s fiscal 2022 segment sales (own work, based on the company’s fiscal 2022 10-K)

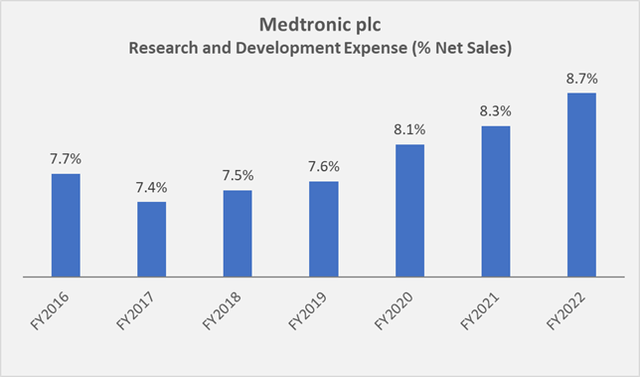

MDT must constantly innovate to differentiate itself from its competitors, so it is not surprising that the company typically launches more than 100 products per year – a pace that smaller competitors in particular struggle to keep up with. In recent years, Medtronic has increasingly invested in research and development, as shown in Figure 2. The company operates in a variety of niches with its medical devices. I view this as a double-edged sword. On the one hand, the company benefits from economies of scale and is therefore able to outcompete smaller rivals. On the other hand, serving many niches with relatively small patient numbers carries the risk of losing focus, which will sooner or later be accompanied by declining profit- and cash flow margins.

Figure 2: Medtronic’s research and development expenses as a percentage of net sales (own work, based on the company’s fiscal 2016 to 2022 10-Ks; note that Medtronic’s fiscal year ends in April)

As mentioned earlier, Medtronic caught my interest because of its commitment to diabetes care. Unlike, for example, Novo Nordisk (NVO), the diabetes drug specialist, Medtronic is involved in the market of diabetes care devices, such as insulin pumps and blood glucose meters. The company has made substantial investments in the past, and its products target a large patient base. However, the market for diabetes treatments is, unsurprisingly, highly competitive, and Medtronic’s performance in this area has been relatively disappointing in recent years. The company is struggling to compete against Abbott, the price leader, and DexCom (DXCM), the quality leader, It has even attracted the attention of the FDA, which issued a warning letter addressing the inadequacy of certain medical device quality system requirements. In addition, the FDA accused Medtronic of being slow on product recalls. The company’s diabetes product sales continue to decline (3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in fiscal 2022 and 5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} organically in the fourth quarter of 2022), but management expects a return to growth soon.

All in all, it doesn’t seem reasonable to conclude that Medtronic’s diabetes segment will be a big profit contributor anytime soon. But even though Medtronic piqued my interest because of its diabetes segment, I still think the company is interesting because of its innovative nature and diversified portfolio.

Profitability and Growth

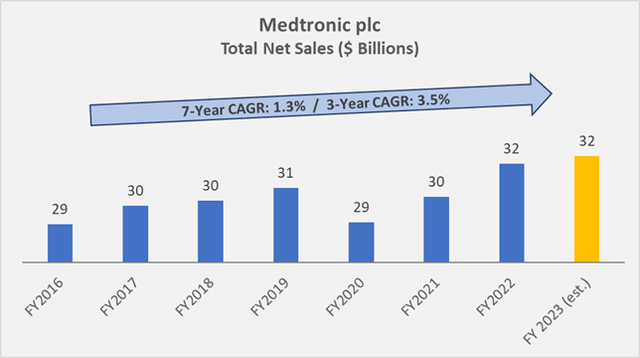

Over the last twenty years, Medtronic’s earnings growth has been extremely consistent (see FAST Graphs chart at the end of the article). However, I have only looked in detail at the company’s performance over the last seven fiscal years because Medtronic acquired Ireland’s Covidien plc in 2015. Because of the timing of the acquisition (January 2015), the fiscal 2015 earnings-related numbers only partially reflect Covidien’s contribution. Compared to fiscal 2014, revenue grew nearly 70{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} through fiscal 2016, indicating that the Covidien transaction was undoubtedly significant for Medtronic, as confirmed by the $50 billion transaction value.

Since 2016, revenue growth has actually been quite weak, with a compound annual growth rate (CAGR) of only 1.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}. In part, the weak growth is due to Medtronic divesting businesses from time to time. For example, in 2017, the company sold its Patient Care, Deep Vein Thrombosis, and Nutritional Insufficiency businesses to Cardinal Health (CAH) for $6.1 billion (p. 70, fiscal 2018 10-K).

Near-term growth was slightly better, but still modest, at 3.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} per year, compounded, and should not be overstated due to the recovery from the pandemic. This shows that many of Medtronic’s products are used in various types of elective procedures.

For fiscal 2023, the company expects sales to exceed $33 billion, but a strong U.S. dollar would negatively impact earnings by about $1 billion if the current exchange rate remains stable for the remainder of the fiscal year.

Figure 3: Medtronic’s net sales since fiscal 2016, the first fiscal year after the acquisition of Covidien plc (own work, based on the company’s fiscal 2016 to 2022 10-Ks; note that Medtronic’s fiscal year ends in April)

Medtronic maintains a relatively consistent operating profitability in the 18{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} range, and the company also has strong free cash flow profitability in the high teens. While JNJ has stronger margins, ABT is pretty much in line with MDT – which is likely due to JNJ’s pharma segment. In terms of free cash flow, Medtronic has a slightly higher cash flow conversion. In recent years, the company generated annualized free cash flow of $6 billion (normalized for working capital movements, stock-based compensation, and impairment charges).

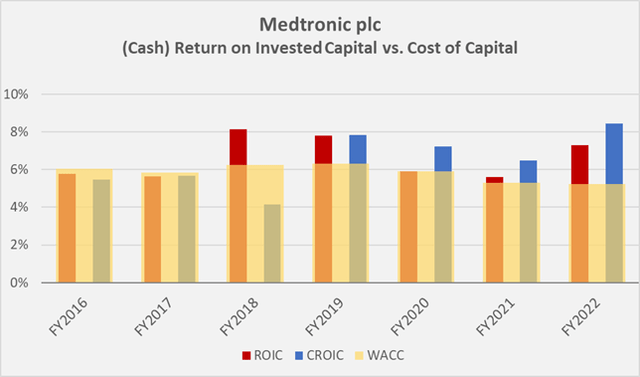

Medtronic’s return on invested capital (ROIC) and cash return on invested capital (CROIC) are surprisingly weak (Figure 4). In fact, Medtronic has often been unable to generate returns in excess of its cost of capital (assuming a 6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} equity risk premium). Of course, only ROIC should be compared to the weighted average cost of capital (WACC, which takes into account both equity and debt). CROIC, which is based on normalized free cash flow, should be compared to the cost of equity, which is inherently higher than WACC. Abbott Laboratories’ returns on capital are similarly weak, while JNJ – again likely due to its pharmaceutical segment – regularly generates returns in excess of 10{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} above its cost of capital.

Figure 4: Medtronic’s (cash) return on invested capital compared to its weighted average cost of capital, assuming an equity risk premium of 6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} (own work, based on the company’s fiscal 2016 to 2022 10-Ks; note that Medtronic’s fiscal year ends in April)

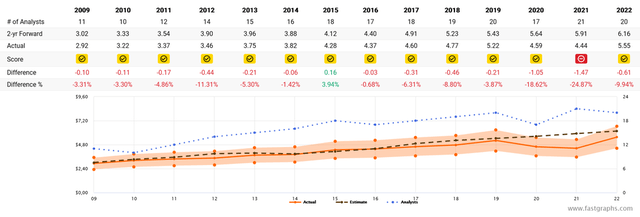

Both the comparatively weak (but still strong in absolute terms) margins and the low returns on capital indicate that the company is probably too diversified and lacks focus. One reason it shares with Abbott is the company’s constant need for innovation and its focus on the medical device sector. Problematic working capital management could be another reason, but Medtronic’s cash conversion cycle has remained remarkably stable since its acquisition of Covidien in 2015, confirming the company’s proper integration, which is not a given, considering Covidien’s size. Going forward, I do not think it is unreasonable to assume the company can achieve healthy growth, especially as elective surgeries will increase after being deferred during the pandemic and the company will certainly leverage its strong pricing power. Conversely, ongoing supply chain disruptions, as well as labor shortages and a strong U.S. dollar, could continue to weigh on results, at least in the near term. According to FAST Graphs, analysts expect earnings to be flat in fiscal 2023, but growth should return to the high single digits thereafter. The two-year forward analyst scorecard suggests that Medtronic’s analysts know the company very well and the company has been able to deliver results in line with estimates, with the understandable exception of pandemic-shaken fiscal years 2020 and 2021 (Figure 5).

Figure 5: Two-year forward analyst scorecard for Medtronic (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

Financial Stability

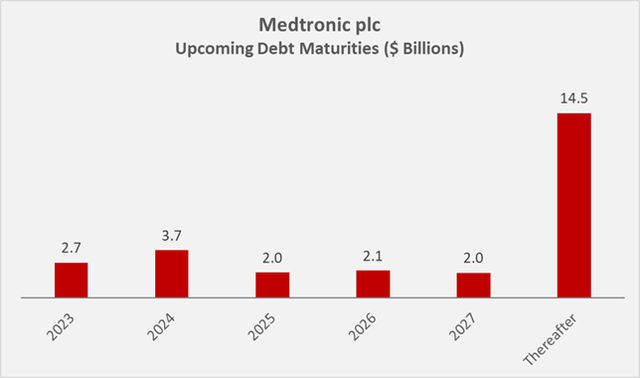

Medtronic is a conservatively financed company, as already suggested by the relatively small gap between market capitalization and enterprise value. The company’s net debt has declined from nearly $20 billion at the end of fiscal 2017 to $13.5 billion at the end of fiscal 2022. This confirms Medtronic’s strong cash generation capabilities, as the company also repurchased shares and rewarded shareholders with a sizable dividend during this period.

If the company were to suspend its dividend and share repurchases (which seems very unrealistic indeed), Medtronic would only need two to three years to pay off all of its debt with its cash flow. Given Medtronic’s good cash flow conversion, it is not surprising that its net debt to EBITDA ratio is also very modest at typically 2x.

Medtronic’s debt maturity profile is also very reassuring, with more than 50{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of its debt maturing after 2027 (Figure 6).

Figure 6: Medtronic’s debt maturity profile at the end of fiscal 2022 (own work, based on the company’s fiscal 2022 10-K)

Therefore, it does not come as a surprise that Medtronic’s long-term debt has been rated A by Standard & Poor’s at the end of fiscal 2022, which enables the company to refinance its debt at comparatively low rates.

Shareholder Returns And Tax Implications

Medtronic is a dividend aristocrat, and the recent 8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} increase is the 45th consecutive increase. That’s downright spectacular, even if behemoth JNJ carries an even stronger track record of 60 years under its belt. Over the past 45 years, Medtronic’s dividend has grown at a CAGR of 16{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}.

The way Medtronic’s management puts its dividend front and center is music to my ears:

We’ve increased our dividend for the past 45 years and growing our dividend is an important component of the total return we generate for our shareholders. – Geoff Martha, CEO

The dividend is covered very well by free cash flow, and the company paid out approximately 50-60{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in recent years. This leaves ample room for growth, even if earnings growth lags in the short-term.

It should be noted that Medtronic is a company that is no longer headquartered in the U.S. since the acquisition of Irish Covidien in 2015. Since then, the company benefits from the country’s more favorable tax regime. This can have implications on the dividend, depending on the investor’s tax residence. According to the company’s fiscal 2022 10-K (p. 23 f.):

Shareholders resident in the U.S. that hold their shares through DTC will not be subject to dividend withholding tax, provided the addresses of the beneficial owners of such shares in the records of the brokers holding such shares are recorded as being in the U.S. (and such brokers have further transmitted the relevant information to a qualifying intermediary appointed by us). However, other shareholders may be subject to dividend withholding tax, which could adversely affect the price of their shares.

However, European investors will most likely see a lower dividend on their accounts and would therefore need to manually reclaim the tax withheld (or at least the qualified portion of it).

Medtronic has historically tapped equity sources to partially fund acquisitions. For example, the number of diluted weighted average shares outstanding increased significantly from 1.11 billion in fiscal 2015 to 1.43 billion in fiscal 2016 as a result of the Covidien acquisition, but since then the company has regularly conducted share repurchases with excess free cash flow. Since fiscal 2016, the number of shares outstanding has decreased by an average of 0.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} per year, more than offsetting the dilution from stock-based compensations.

Valuation and Verdict

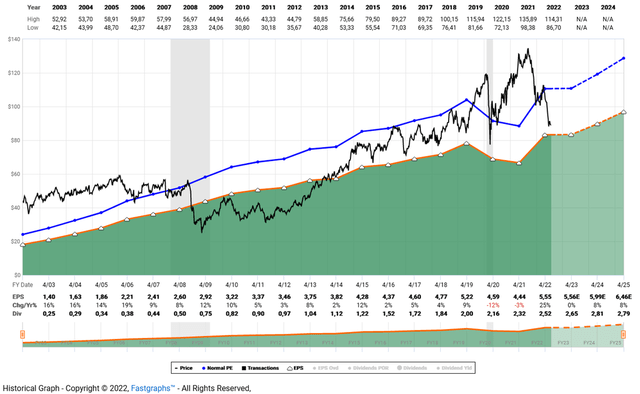

Given the remarkably consistent earnings profile and the fact that analysts’ estimates are typically in line with actual results, I think Medtronic’s FAST Graphs chart is a good approach to valuing the stock.

The chart shows the pandemic-related earnings decline very clearly, but Medtronic is expected to return to growth in line with the pre-pandemic years in fiscal 2024. The stock has recovered somewhat from the exuberant all-time high it reached in mid-2021, but I still think it is a bit too expensive. Medtronic’s long-term growth rate, uncertainties surrounding its diabetes portfolio, and the fact that many of the company’s products are used in elective procedures lead me to pay an earnings multiple of 15 or less, even though I realize I may not be able to buy the stock at this level anytime soon. Another reason is that management leaves something to be desired, as evidenced by the poor performance of the diabetes portfolio and the fact that the FDA saw reasons to issue a warning letter.

From a dividend growth investor’s perspective, Medtronic’s dividend yield, currently 3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, is significantly higher than the long-term average yield, suggesting undervaluation. Given the strong dividend growth, management’s shareholder-friendly stance, and low payout ratio, I see no reason why growth should slow.

All in all, I am somewhat ambivalent about Medtronic. Management’s shareholder-friendly stance, the remarkably consistent growth pre-pandemic, coupled with a market-leading position in many areas, and the basically recession-resistant product portfolio make me want to own a position in the company. However, the weak returns on capital and management’s apparent missteps with respect to the diabetes portfolio have dampened my enthusiasm. I would consider building a small position in Medtronic in the $70 range, but wouldn’t mind too much if the stock doesn’t fall to that level. I already own a sizable position in JNJ and am currently investigating Abbott Laboratories as a potential addition to my portfolio. As a European investor, the bureaucratic burden of manually reclaiming withheld taxes is another argument against investing in Medtronic, albeit a very small one.

Figure 7: FAST Graphs chart for MDT, based on adjusted operating earnings (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.