Insiders who acquired US$4.0m really worth of Franchise Group, Inc. (NASDAQ:FRG) stock in the last yr recovered section of their losses as the inventory rose by 5.{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} final 7 days. The invest in, nonetheless, has tested to be a dear guess, with losses at present totalling US$556k.

Whilst we would by no means recommend that buyers really should base their choices solely on what the administrators of a enterprise have been accomplishing, we would consider it silly to dismiss insider transactions completely.

See our hottest evaluation for Franchise Group

The Past 12 Months Of Insider Transactions At Franchise Team

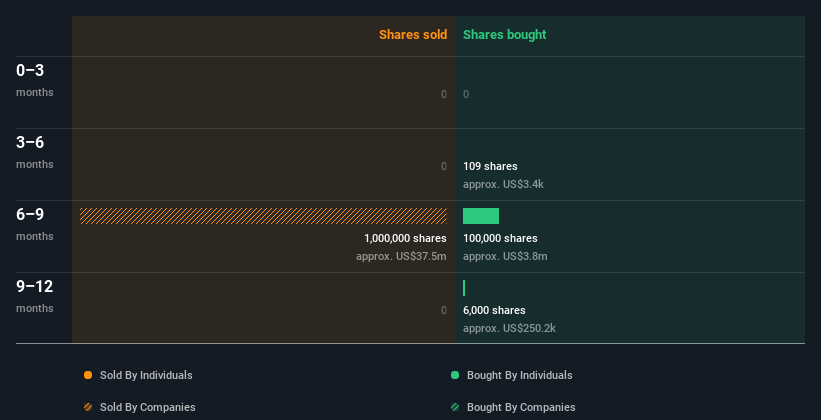

In the last twelve months, the most important one acquire by an insider was when President Brian Kahn bought US$3.8m really worth of shares at a selling price of US$37.50 for each share. That suggests that an insider was satisfied to acquire shares at earlier mentioned the present selling price of US$32.48. Their watch could have altered given that then, but at the very least it reveals they felt optimistic at the time. To us, it is incredibly vital to think about the cost insiders shell out for shares. As a standard rule, we really feel much more beneficial about a inventory if insiders have acquired shares at previously mentioned present rates, due to the fact that suggests they viewed the stock as excellent price, even at a bigger selling price.

In the past twelve months Franchise Team insiders have been shopping for shares, but not promoting. You can see the insider transactions (by organizations and people) more than the previous calendar year depicted in the chart below. If you want to know particularly who offered, for how a great deal, and when, merely click on the graph underneath!

Franchise Team is not the only inventory insiders are getting. So consider a peek at this free of charge list of increasing corporations with insider purchasing.

Does Franchise Team Boast Higher Insider Ownership?

Several buyers like to examine how substantially of a company is owned by insiders. Commonly, the higher the insider possession, the far more likely it is that insiders will be incentivised to construct the organization for the extensive time period. Franchise Team insiders personal 33{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of the firm, currently value about US$406m based on the new share value. I like to see this level of insider ownership, for the reason that it boosts the odds that administration are contemplating about the greatest passions of shareholders.

So What Does This Data Recommend About Franchise Group Insiders?

There haven’t been any insider transactions in the past three months — that isn’t going to indicate substantially. But insiders have proven much more of an hunger for the stock, more than the last 12 months. Judging from their transactions, and large insider ownership, Franchise Group insiders truly feel fantastic about the company’s foreseeable future. So these insider transactions can assistance us create a thesis about the inventory, but it truly is also worthwhile understanding the risks facing this corporation. At Merely Wall St, we have observed that Franchise Team has 3 warning indicators (2 are concerning!) that are entitled to your focus right before likely any more with your evaluation.

But note: Franchise Group may perhaps not be the very best stock to obtain. So acquire a peek at this absolutely free checklist of intriguing firms with substantial ROE and low personal debt.

For the reasons of this post, insiders are individuals individuals who report their transactions to the relevant regulatory entire body. We at this time account for open up industry transactions and non-public tendencies, but not spinoff transactions.

Have comments on this report? Anxious about the articles? Get in contact with us directly. Alternatively, email editorial-group (at) simplywallst.com.

This report by Simply Wall St is general in nature. We supply commentary primarily based on historic info and analyst forecasts only making use of an impartial methodology and our articles are not meant to be economical assistance. It does not constitute a suggestion to buy or promote any stock, and does not acquire account of your objectives, or your money scenario. We goal to provide you lengthy-expression concentrated analysis pushed by basic details. Take note that our assessment could not component in the latest selling price-delicate firm bulletins or qualitative materials. Just Wall St has no placement in any shares described.

Be part of A Compensated User Investigate Session

You are going to obtain a US$30 Amazon Present card for 1 hour of your time when aiding us construct improved investing resources for the person traders like by yourself. Indicator up in this article