Q1 2022 Franchise Royalties Double YoY to $6.6 million

GOOSE CREEK, SC / ACCESSWIRE / May 10, 2022 / HireQuest, Inc. (NASDAQ:HQI), a national franchisor of direct dispatch, executive search, and commercial staffing services, today reported financial results for the first quarter ended March 31, 2022.

First Quarter 2022 Summary

-

Franchise royalties increased 101.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} to $6.6 million compared to $3.3 million in the prior year period. Organic royalties, excluding the effect of acquisitions, of $4.2 million grew 29.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} over the prior year period.

-

Staffing revenue from owned locations was $1.1 million.

-

Service revenue increased 225.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} to $468,000 compared to $144,000 in the prior year period.

-

Total revenue increased 139.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} to $8.1 million compared to $3.4 million in the prior year period.

-

Net Income was $603,000, or $0.04 per diluted share, compared to net income of $3.7 million, or $0.27 per diluted share in the prior year period. The decrease was primarily due to $3.6 million, or $3.0 million after tax, in expenses related to converting newly acquired business into franchises.

-

Record Adjusted EBITDA of $5.3 million compared to $1.5 million in the prior year period.

Subsequent to Quarter End

-

The Company’s Board of Directors declared a quarterly cash dividend of $0.06 per share of common stock to be paid on June 15, 2022, to shareholders of record as of June 1, 2022.

System-wide sales for the first quarter of 2022 were $101.0 million compared to $56.1 million for the same period in 2021. Existing franchisees grew organic system-wide sales 35.0{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} compared to the prior year period.

Rick Hermanns, HireQuest’s President and Chief Executive Officer, commented on the results, “Our first quarter provided a strong start to 2022, with continued organic growth from our differentiated franchise model combined with acquisition growth resulting in Adjusted EBITDA of $5.3 million. During the quarter we completed three acquisitions. The staffing division of dmDickason adds three locations, expanding our franchise base in West Texas and New Mexico. The Dubin Group and Dubin Workforce Solutions mark our entry into Pennsylvania. Northbound Executive Search adds New York to our map and expands HireQuest’s franchise offerings into the higher margin executive placement vertical. These acquisitions combined for over $35 million in sales for 2021 and we now have a foothold in virtually all segments of the $161 billion staffing and recruiting marketplace, with considerable opportunities for growth.

Mr. Hermanns concluded, “In conjunction with the acquisitions, we realized $3.6 million in expenses with the partial conversion of these acquisitions to franchises consistent with our growth strategy. We continue to focus on growing our asset light scalable business model which we expect will yield substantial long-term operating leverage as the business continues to grow.”

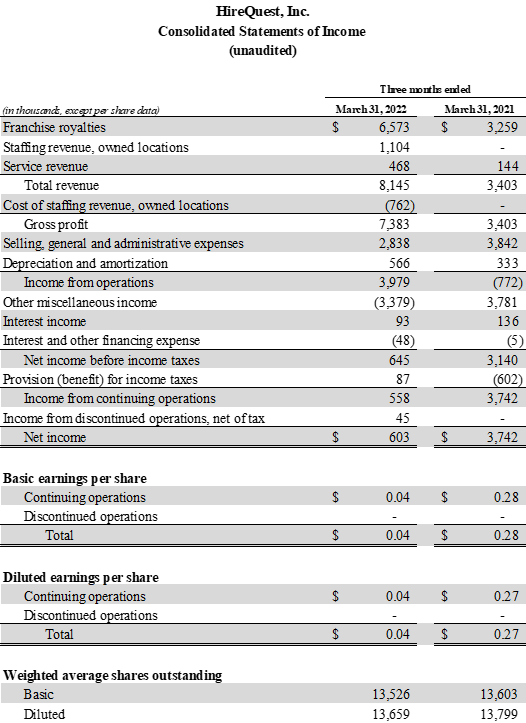

First Quarter 2022 Financial Results

The company’s gross profit is calculated by aggregating its revenue derived from franchise royalties, gross profit from owned locations, and service revenue. Franchise royalties are the royalties earned from franchisees primarily on the basis of their sales to their customers. Gross profit from owned locations is sales at owned locations less cost of staffing revenue. Service revenue consists of interest charged to franchisees on overdue accounts and other fees for optional services we provide our franchisees.

Franchise royalties in the first quarter of 2022 were $6.6 million compared to $3.3 million in the year-ago quarter. Organically, excluding the contribution from acquisitions, franchise royalties increased 29.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}.Service revenue was $468,000 compared to $144,000 in the prior-year quarter, an increase of 225.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}. Staffing revenue from owned locations was $1.1 million. Total revenue in the first quarter of 2022 was $8.1 million compared to $3.4 million in the year-ago quarter, an increase of 139.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}.

Gross profit in the first quarter of 2022 was $7.4 million compared to $3.4 million in the year-ago quarter, an increase of 117.0{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}.

Selling, general and administrative (“SG&A”) expenses in the first quarter of 2022 were $2.8 million or 38.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of gross profit compared to $3.8 million, or 112.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of gross profit for the first quarter last year. The first quarter of 2021 included approximately $1.4 million of non-recurring, acquisition-related expenses.

Net Income in the first quarter of 2022 was $603,000, or $0.04 per diluted share, compared to net income of $3.7 million, or $0.27 per diluted share, in the first quarter last year. The decrease was primarily due to $3.6 million, or $3.0 million after tax, in expenses related to converting newly acquired business into franchises.

Adjusted EBITDA for the first quarter of 2022 was $5.3 million compared to $1.5 million in the first quarter last year.

Balance Sheet and Capital Structure

Cash was $1.8 million as of March 31, 2022, compared to $1.3 million as of December 31, 2021.

Total assets were $85.3 million as of March 31, 2022. Total liabilities were $38.3 million.

Working capital as of March 31, 2022 was $18.9 million compared to $20.5 million at December 31, 2021.

At March 31, 2022 the Company had approximately $19.2 million in availability on its revolving credit facility.

On March 15, 2022, the company paid a quarterly cash dividend of $0.06 per share of common stock to shareholders of record as of March 1, 2022, its seventh consecutive quarterly dividend. The Company intends to pay a $0.06 cash dividend on a quarterly basis, but the exact amount each quarter will be based on its business results and financial position.

Conference Call

HireQuest will hold a conference call to discuss its financial results.

Date: Tuesday, May 10, 2022

Time: 4:30 p.m. Eastern time

Toll-free dial-in number: 877-545-0320

International dial-in number: 973-528-0002

Entry Code: 605523

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization.

The conference call will be broadcast live and available for replay at https://www.webcaster4.com/Webcast/Page/2359/45438 and via the investor relations section of HireQuest’s website at www.hirequest.com.

A replay of the conference call will be available through May 24, 2022.

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 45438

About HireQuest

HireQuest, Inc. is a nationwide franchisor of direct dispatch, executive search, and commercial staffing solutions for HireQuest Direct, HireQuest, Snelling, Link, and Northbound Executive Search franchised offices across the United States. Through its national network of over 220 franchisee-owned offices in more than 36 states and the District of Columbia, HireQuest provides employment for approximately 73,000 individuals annually that work for thousands of customers in numerous industries including construction, light industrial, manufacturing, hospitality, clerical, medical, travel, financial services, and event services. For more information, visit www.hirequest.com.

Important Cautions Regarding Forward-Looking Statements

This news release includes, and the company’s officers and other representatives may sometimes make or provide certain estimates and other forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act, including, among others, statements with respect to future economic conditions, future revenue or sales and the growth thereof; operating results; anticipated benefits of the acquisition of Snelling and/or Link, or the status of integration of those entities. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will,” and similar references to future periods.

While the company believes these statements are accurate, forward-looking statements are not historical facts and are inherently uncertain. They are based only on the company’s current beliefs, expectations, and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. The company cannot assure you that these expectations will occur, and its actual results may be significantly different. Therefore, you should not place undue reliance on these forward-looking statements. Important factors that may cause actual results to differ materially from those contemplated in any forward-looking statements made by the company include the following: the level of demand and financial performance of the temporary staffing industry; the financial performance of the company’s franchisees; changes in customer demand; the effects of any global pandemic including the impact of COVID-19; the relative success or failure of acquisitions and new franchised offerings; the extent to which the company is successful in gaining new long-term relationships with customers or retaining existing ones, and the level of service failures that could lead customers to use competitors’ services; significant investigative or legal proceedings including, without limitation, those brought about by the existing regulatory environment or changes in the regulations governing the temporary staffing industry and those arising from the action or inaction of the company’s franchisees and temporary employees; strategic actions, including acquisitions and dispositions and the company’s success in integrating acquired businesses including, without limitation, successful integration following any of our various acquisitions; disruptions to the company’s technology network including computer systems and software; natural events such as severe weather, fires, floods, and earthquakes, or man-made or other disruptions of the company’s operating systems; and the factors discussed in the “Risk Factors” section and elsewhere in the company’s most recent Annual Report on Form 10-K.

Any forward-looking statement made by the company or its management in this news release is based only on information currently available to the company and speaks only as of the date on which it is made. The company and its management disclaim any obligation to update or revise any forward-looking statement, whether written or oral, that may be made from time to time, based on the occurrence of future events, the receipt of new information, or otherwise, except as required by law.

Company Contact:

HireQuest, Inc.

David Hartley, Director of Corporate Development

(800) 835-6755

Email: [email protected]

Investor Relations Contact:

IMS Investor Relations

John Nesbett/Jennifer Belodeau

(203) 972-9200

Email: [email protected]

— Tables Follow —

SOURCE: HireQuest Inc.

View source version on accesswire.com:

https://www.accesswire.com/700810/HireQuest-Reports-Financial-Results-for-First-Quarter-2022