Amid significant inflation, supply chain woes and rising affordability issues, U.S. homebuilders are experiencing moderate housing demand. Also, they are incurring high costs to support current operations and expected growth. Recently, a notable homebuilder, KB Home KBH, reported its second-quarter fiscal 2022 results.

Although it generated solid earnings and revenues year over year, its net orders dropped 9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} from the prior-year quarter. The cancellation rate, as a percentage of gross orders, rose to 17{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} compared with 9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} a year ago. Due to the growing uncertainty in the market, it has narrowed its previously-announced guidance for fiscal 2022.

Nonetheless, KBH remains confident about its Built-to-Order business model, enabling it to navigate these changing market conditions. (Read more: KB Home’s Q2 Earnings & Revenues Beat, Margins Up Y/Y)

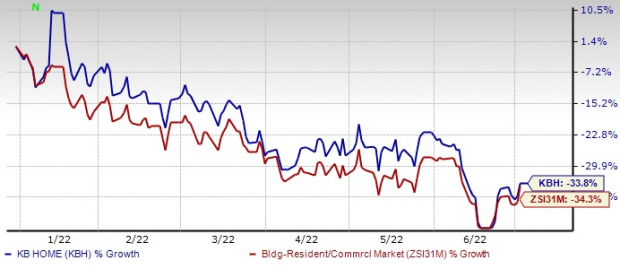

Its continuous focus on the Returns-Focused Growth plan, consumer-centric approach and favorable pricing environment are helping it to mitigate these challenges. KBH’s shares slightly outperformed the Zacks Building Products – Home Builders industry this year.

Image Source: Zacks Investment Research

Let’s discuss factors influencing this Zacks Rank #3 (Hold) company’s growth prospects. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Strategic Growth initiatives Solid, Supply-Chain & Costs Issue Persist

Over the past six years, KB Home has been pursuing a Returns-Focused Growth Plan that is designed to drive revenues and margins, return on invested capital and equity and maintain leverage ratio. The plan mainly focuses on executing its core business strategy, improving asset efficiency and monetizing significant deferred tax assets.

KB Home is in a better position to expect meaningful growth in fiscal 2022, attributable to an increase in backlog and its ability to match housing starts to net orders. The company is executing its plan to expand the scale of operations while driving both margins and returns.

However, it has been witnessing challenges related to raw material shortages and municipal delays. Raw material inflation is eating into homebuilders’ margins. Also, labor shortages are leading to higher wages and construction delays, eventually hurting the number of homes delivered. Land prices are also increasing due to limited availability. Owing to these headwinds, KBH reduced its year-end community count to 250 in fiscal 2022 from 255 expected earlier.

Built-to-Order Approach Attracts, Affordability Issue Worries

KB Home’s highly consumer-centric approach helps homebuyers design a home with the features and amenities of their choice. It provides buyers with a wide range of choices in the major aspects of their future home and a personalized customer experience through in-house community teams.

This approach has given KB Home a competitive advantage over its peers and led to low-cost production. The company follows a strategy of initiating construction only after a purchase agreement has been executed. This reduces inventory risk, enhances efficiencies in construction and provides greater visibility and predictability on future deliveries.

However, significantly high home prices and Fed’s expectation of future interest rate hikes have made homebuyers apprehensive. Per the recent report from the Census Government, the median sales price of new houses sold in May was up 15{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} year over year. The average sales price also rose 14.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} from the prior-year period. Consumer confidence dropped 4.5 points in June, the lowest level since February 2021, due to decades of high inflation.

Although home prices have started moderating, the trend is likely to remain consistent for housing this year.

Supply Constraint Limits Land Acquisition Move

KB Home invests aggressively in land acquisition and development, mainly in high-end locations, which is critical for community count as well as top-line growth. During fiscal second-quarter 2022, the company expanded its lot position to 89,778 lots owned or controlled. The lot pipeline has expanded 16{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} since May 31, 2021, reflecting KBH’s substantial investments in land and land development over the past 12 months. In the first half of fiscal 2022, it invested $1.40 billion in land acquisitions and development, up 24{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} year over year.

However, a shortage of buildable lots, skilled labor and available capital for smaller builders are limiting home production, which is lowering the inventory of new and existing homes. Limited capital for land and land development has left entitled lands in short supply while growing demand drove land prices higher. The labor market is tightened with the limited availability of labor, arresting the rapid growth in housing production. If the supply picture does not improve, prices could increase, affecting affordability.

2 Better Ranked Stocks From the Same Industry

Two better-ranked stocks which warrant a look in the same space are Meritage Homes Corporation MTH and Toll Brothers, Inc. TOL.

Meritage Homes is one of the leading designers and builders of single-family homes. The company currently sports a Zacks Rank #2 (Buy).

Meritage Homes has declined 36.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} year to date. That said, earnings are expected to grow 42.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in 2022. Earnings estimates have moved 1.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} north for 2022 over the past 60 days.

Toll Brothers is a leading builder of luxury homes. The company has been benefiting from its strategy of broadening the product lines, price points and geographies. Also, it has been gaining from a favorable housing backdrop, lack of competition in the luxury new home market and buyout synergies.

Earnings for Toll Brothers — carrying a Zacks Rank #2 — are expected to grow 53.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in fiscal 2022. It has declined 35{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} this year. Toll Brothers has seen an upward estimate revision of 3.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} for fiscal 2022 earnings over the past 60 days.

A Recent Homebuilding Release

Lennar Corporation LEN reported second-quarter fiscal 2022 (ended May 31, 2022) results. Quarterly earnings and revenues topped the Zacks Consensus Estimate, despite unprecedented supply-chain challenges.

Lennar has declined 46.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} year to date. That said, earnings are expected to grow 42.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in 2022. Earnings estimates for 2022 have moved 1.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} north in the past 30 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in little more than 9 months and NVIDIA which boomed +175.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in one year.

Free: See Our Top Stock and 4 Runners Up >>

Toll Brothers Inc. (TOL): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Lennar Corporation (LEN): Free Stock Analysis Report

Meritage Homes Corporation (MTH): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.