|

Fund details |

||||

|

Benchmark |

Russell Microcap® Index3 |

|||

|

Inception date |

5 September 2014 |

|||

|

Fund size |

A$79.9 million |

|||

|

Performance1 – 30 September 2022 |

||||

|

Fund2 |

Russell Microcap® |

Difference |

||

|

1 month |

(3.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

(3.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

0.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

3 months |

2.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

6.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

(4.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

|

|

1 year |

(18.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

(18.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

(0.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

|

|

2 years p.a. |

12.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

14.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

(2.0{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

|

|

3 years p.a. |

6.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

8.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

(1.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

|

|

5 years p.a. |

6.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

7.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

(0.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

|

|

Since inception p.a.2 |

9.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

10.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

(0.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) |

|

Market commentary

The Russell Microcap® Index returned 6.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in Q3 2022. Health Care (+13.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) was the best performing sector, followed by Energy (+6.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) and Utilities (-2.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}). Consumer Staples (-13.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) performed the worst, followed by Communication Services (-10.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}) and Real Estate (-10.0{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}).

US Equities ended the quarter broadly lower despite a very strong start in July. September was the worst month in Q3 driven by a number of factors including the rise in interest rates, energy security in Europe and increasing investor fears going into the Q3 earnings season despite easing inflationary pressures and supply chain dynamics.

The US Government 10 year yield rose above 4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} for the first time since the GFC, driving US mortgage rates above 7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, the highest since 2007. September also saw the dollar strengthening to the highest level in over 20 years. Although the Fed rate hike was followed by ECB, BoE and other central banks, they failed to keep up with Fed’s pace.

Current economic, health and geopolitical events are fostering an environment in which governments and corresponding agencies appear to be having a greater economic and social impact on businesses and individuals. While well intended, some of the policies created can have damaging impacts and the urge by politicians to “double down” on bad policies happens more frequently than it should.

Conversely, there have been amazing partnerships between the government and private sector which have served to propel the US forward. Today we are experiencing outsized impacts from the Centers for Disease and Prevention and Control (CDC) on personal health and the economy, the Federal Reserve on personal finance and economy and Congress on energy usage, the economy and decarbonisation. These impacts are all converging on capital markets simultaneously creating a period of heightened volatility.

Both opportunities and risks are emerging real time creating an ideal time for active management and some of these are discussed below.

The Fed Ramps up the Inflation Battle

The US Federal Reserve and their decisions regarding monetary policy are taking centre stage as market participants analyse the current and future direction of interest rates. Words, speeches, and actions are creating exaggerated moves in asset prices. On September 21, the Fed, in a unanimous decision, raised rates by 75 basis points and indicated further rates are likely. Chair Powell noted that the Fed would “keep at it” until the job is done. He has signaled that they will tolerate below trend growth and even a recession to reach the desired level of price stability.

The Fed’s mission to quell inflation via momentary policy (higher rates and Quantitative Tightening) was launched quickly after the US experienced one year of inflation. This short inflationary period follows two decades of disinflation and numerous Quantitively Easing (QE) programs which ballooned the Federal Reserve’s balance sheet to approximately US$8.5 trillion (37{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of US 2022 GDP).

There are numerous data points showing that many elements which drove the high inflation readings are cooling off. Certain commodity prices, used cars and housing are all showing signs of easing. Lumber prices (key raw material for housing) has fallen to pre Covid levels. As THB has written about in past letters, inflation is comprised of cyclical, secular, and structural elements. All of them will not move uniformly. Additionally, due to the economy being essentially shut, the Government provided approximately $4.6T of stimulus which had a distorting/inflationary impact on normal economic conditions.

CHIPS and Science Act

The CHIPS and Science Act of 2022 was signed into law on August 9 and allocates $52.7 billion in grants and loans for semiconductor manufacturing plants and a tax credit for semiconductor plant construction, estimated to cost an additional $24 billion for the government. The funds will be allocated in parts ending in 2027.

The tax credit, called the Advanced Manufacturing Tax Credit, is a 25{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} tax credit equal to the tax basis of semiconductor manufacturing plants that begin construction before January 1, 2027. This tax credit is incentivising American and foreign chipmakers to build semiconductor manufacturing plants in the US.

This is an initiative from the US government to help reduce American reliance on foreign supply chains for critical components and increase the US share of semiconductor manufacturing, which currently stands at around 13{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}. In the 1990s, the US manufactured 37{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} of chips worldwide, but the manufacturing has mostly shifted overseas. The CHIPS Act aims to shift new manufacturing plants towards US soil.

Peak globalisation combined with geopolitical instability has prompted companies to secure the reliability of their supply chain over the margin advantages of outsourcing. Chipmakers like Intel and EV battery makers like Panasonic, Honda, and Toyota have announced capital projects in several states in the US. The CHIPS act should amplify manufacturing capital which is already moving to the US.

Portfolio commentary

The THB US Micro Cap Fund returned 2.1{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} in AUD (net of fees) in Q3 2022.

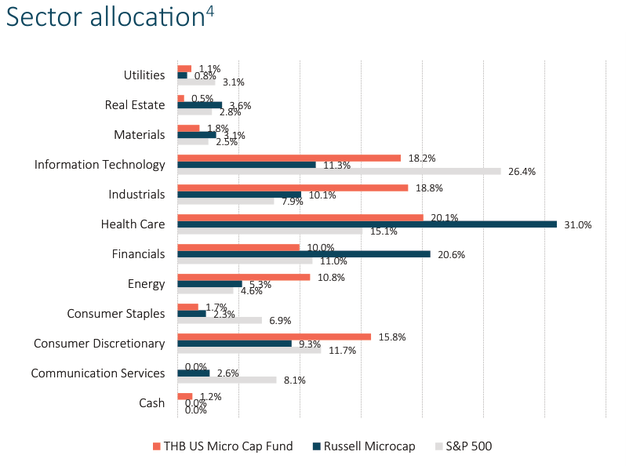

The portfolio saw positive contribution from stock selection in Consumer Staples (+1.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}), stock selection in Industrials (+1.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}), and underallocation to Real Estate (+0.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}). Negative contribution came mainly from stock selection in Health Care (-4.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}), overallocation to Consumer Discretionary (-0.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}), and underallocation to Consumer Staples (-0.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}).

The top five performing stocks (from a contribution standpoint) were Transcat, Inc. (TRNS, Industrials, +0.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); NAPCO Security Technologies, Inc. (NSSC, Information Technology, +0.7{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); BioLife Solutions, Inc. (BLFS, Health Care, +0.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); Quest Resource Holding, Corp. (QRHC, Industrials, +0.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); and Catalyst Pharmaceuticals, Inc. (CPRX, Health Care, +0.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}).

The bottom five performing stocks (from a contribution standpoint) were Greenbrier Companies, Inc. (GBX, Industrials, -0.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); ePlus, Inc. (PLUS, Information Technology, -0.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); Holley Inc. (HLLY, Consumer Discretionary, -0.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); Profire Energy, Inc. (PFIE, Energy, -0.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}); and Latham Group Inc. (SWIM, Consumer Discretionary, -0.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}).

During the quarter a select group of biotechnology companies drove an outsized percentage of the benchmark return. THB will not invest in unprofitable companies and that detracted from performance this quarter.

During the quarter, THB’s portfolio companies announced 19 acquisitions and three stock repurchase authorisations.

Stock in focus

BioLife Solutions is a recent addition to the strategy and highlights how cooperation between the public and private sector can yield positive results.

In its earlier stages in the 2000s, BioLife received grants from the National Institute of Health and the National Science Foundation valued at $1.38 million. These grants helped the company conduct research on its HypoThermosol technology for hypothermic preservation of cells. The company performed research on optimising preservation media and examining cellular apoptosis. More recently, the company has been granted patents for cryopreservation technology and gene therapy bioproduction, which focus on storage and transportation of biologic material for cell and gene therapies.

Biolife Solutions manufactures bioproduction tools and services to the cell and gene therapy (“CGT”) industry and broader biopharma market, used in basic and applied research and commercial manufacturing of biologic-based therapies. Customers use its products to maintain the health and function of biologic material during several steps of bioproduction process such as sourcing, manufacturing, storage, and distribution.

The company has a strong IP portfolio of 153 patents covering 52 patents in cell processing, 90 in freezers and thaw systems and 11 in storage and cold chain services. For example, its proprietary biopreservation media products, HypoThermosol® FRS and CryoStor®, are formulated to mitigate preservation-induced, delayed-onset cell damage and death, which result when cells and tissues are subjected to reduced temperatures.

Biolife’s technology can provide CGT customers with significant shelf life extension of biologic source material and final cell products, and can also greatly improve post-preservation cell and tissue viability and function.

The company is executing on its strategy to increase its share of “per dose spend” per customer via acquiring synergistic products and technologies. Biolife has completed nine acquisitions since 2018 for total of $430M.

The company is also benefitting from strong organic growth driven by strong innovation pipeline in cell and gene therapies. The CGT market has been rapidly expanding, treating diseases once thought incurable. According to the Alliance for Regenerative Medicine (“ARM”), there were over $23.1 billion in total global financings in the regenerative market raised in 2021. The FDA predicts somewhere between 10 to 20 cell and gene therapies per year will be approved by 2025.

Portfolio statistics5As at 30 September 2022 |

Top 10 holdings |

|||||

|

Fund |

Russell Microcap® |

Stock |

Sector |

Portfolio weight |

||

|

Weighted avg market cap |

US$791m |

US$628m |

Transcat Inc (TRNS) |

Industrials |

3.5{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Price/sales |

1.0x |

1.2x |

TETRA Technologies Inc (TTI) |

Energy |

2.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Price/book |

1.6x |

1.5x |

NAPCO Security Technologies (NSSC) |

Technology |

2.8{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Dividend yield |

0.9{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

1.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

RPC Inc (RES) |

Energy |

2.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Number of securities |

92 |

1,779 |

LeMaitre Vascular Inc (LMAT) |

Health Care |

2.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Standard deviation |

21.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

21.6{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

Heritage Financial Corporation (HFWA) |

Financials |

2.4{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Sharpe ratio |

0.3 |

0.3 |

First Busey Corporation (BUSE) |

Financials |

2.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

|

|

Beta |

0.9 |

Grid Dynamics Holdings Inc (GDYN) |

Technology |

2.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

||

|

Tracking error |

6.2 |

Movado Group Inc (MOV) |

Consumer Disc |

2.3{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

||

|

Information ratio |

0.0 |

ePlus Inc (PLUS) |

Technology |

2.2{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6} |

||

|

Source: THB Asset Management |

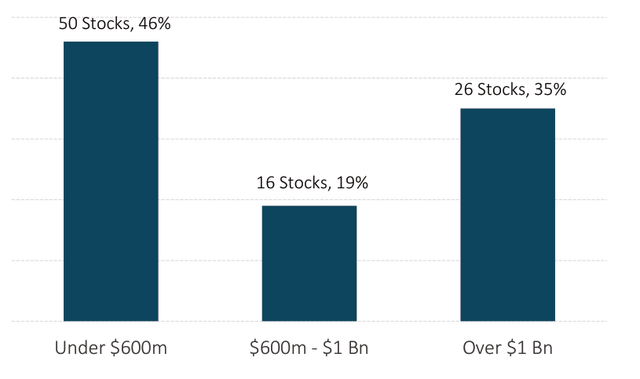

Companies by market capitalisation

Source: THB Asset Management

| 1Performance figures are presented in AUD on a net, pre-tax basis and assume the reinvestment of distributions. Past performance is not an indicator of future performance. Figures in the table may not sum correctly due to rounding. 2Fund inception date was 5 September 2014 however inception performance is calculated from 1 October 2014. 3The Russell Microcap Index is a capitalisation weighted index of 2,000 stocks that captures the smallest 1,000 companies in the Russell 2000 and 1,000 smaller US based listed stocks. 4Portfolio holdings and allocations are subject to change and should not be considered as investment recommendations to trade individual securities. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified were or will be profitable. There is no assurance that any securities discussed herein will remain in the portfolio at the time you receive this report, or that securities sold have not been repurchased. There can be no assurance that investment objectives will be achieved. A full list showing every holding’s contribution to the overall account’s performance during the measurement period and calculation methodology is available upon request. 5Portfolio statistics are reported in USD. Source: THB Asset Management |

|

THB Asset Management (THB), an investment franchise of Victory Capital Management Inc., is a dedicated micro and small cap specialist investment franchise based in Connecticut, USA. Founded in 1982, THB Asset Management has 39 years’ experience investing in micro and small cap companies. THB’s US Micro Cap strategy is based on the belief that there are inefficiencies in the micro cap segment of the market due to lack of analyst coverage, difficulty in identifying value and the impact that management skill has on the direction of smaller companies. THB utilises a disciplined, fundamental bottom-up approach that blends both qualitative and quantitative methods to construct a well-diversified portfolio of companies that possess attractive operating metrics, yet with comparable valuation to the Russell Microcap® Index. This document has been prepared and issued by Victory Capital Management Inc.(Victory) (AFSL 528472) and is intended for the general information of ‘wholesale clients’ (as defined in the Corporations Act 2001) only. Victory is not licensed to provide financial services to retail clients in Australia. Victory is regulated by the Securities and Exchange Commission of the United States of America under US laws, which differ from Australian laws. Equity Trustees Limited (Equity Trustees) (ABN 46 004 031 298, AFSL 240975) is a subsidiary of EQT Holdings Limited (ABN 22607 797 615), a publicly listed company on the Australian Securities Exchange (ASX:EQT). Equity Trustees is the Responsible Entity of the THB US Micro Cap Fund (ARSN 600 158 450). This document is neither an offer to sell or a solicitation of any offer to acquire interests in any investment. The information contained in this document is of a general nature only. Accordingly, reliance should not be placed on this information as the basis for making an investment, financial or other decision. In preparing this document, Victory has not taken into account the investment objectives, financial situation and needs of any particular person. Before making any investment decision, you should consider whether the investment is appropriate in light of those matters. Whilst every effort is taken to ensure the information in this document is accurate, Victory and Equity Trustees provides no warranty as to the accuracy, reliability and completeness of the information in this document and you rely on this information at your own risk. To the extent permitted by law, Victory and Equity Trustees disclaims all liability to any person relying on the information contained in this document in respect of any loss or damage (including consequential loss or damage) however caused, which may be suffered or arise directly or indirectly in respect of such information. Past performance is not a reliable indicator of future performance. The return of capital or any particular rate of return from the Fund is not guaranteed. You should obtain and consider the Fund’s Product Disclosure Statement (PDS) before deciding whether to acquire, or continue to hold, an interest in the Fund. Applications can only be accepted on an application form attached to a current Product Disclosure Statement. Neither Victory, Equity Trustees nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. THB US Micro Cap Fund’s Target Market Determination is available here. A Target Market Determination is a document which is required to be made available from 5 October 2021. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.