Franchise Team, Inc. (NASDAQ:FRG), may possibly not be a large cap inventory, but it saw substantial share price movement during modern months on the NASDAQGM, growing to highs of US$36.69 and slipping to the lows of US$24.02. Some share price tag movements can give investors a much better prospect to enter into the inventory, and perhaps purchase at a lessen rate. A concern to respond to is irrespective of whether Franchise Group’s present-day buying and selling selling price of US$25.87 reflective of the precise price of the compact-cap? Or is it at the moment undervalued, giving us with the opportunity to acquire? Let’s consider a seem at Franchise Group’s outlook and benefit primarily based on the most new fiscal details to see if there are any catalysts for a selling price modify.

See our most up-to-date assessment for Franchise Team

What Is Franchise Team Well worth?

In accordance to my price tag multiple design, which helps make a comparison amongst the company’s rate-to-earnings ratio and the marketplace typical, the stock price appears to be justfied. I’ve applied the price tag-to-earnings ratio in this occasion since there is not enough visibility to forecast its income flows. The stock’s ratio of 13.11x is at this time trading somewhat beneath its sector peers’ ratio of 16.47x, which means if you obtain Franchise Group today, you’d be paying out a realistic price tag for it. And if you believe that Franchise Team need to be investing in this assortment, then there is not considerably room for the share cost to grow outside of the amounts of other marketplace friends more than the extended-expression. So, is there an additional possibility to acquire small in the potential? Provided that Franchise Group’s share is rather unstable (i.e. its selling price movements are magnified relative to the relaxation of the sector) this could indicate the value can sink decreased, supplying us an prospect to acquire afterwards on. This is based mostly on its large beta, which is a fantastic indicator for share selling price volatility.

What does the long term of Franchise Group glance like?

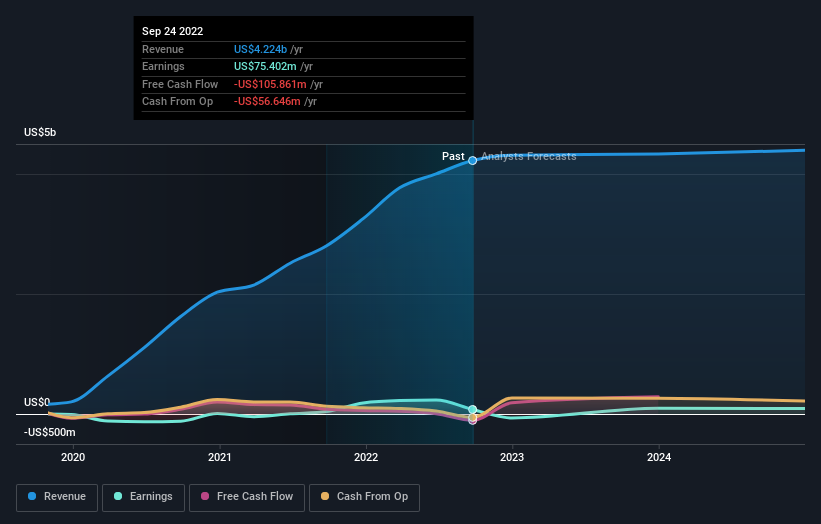

Buyers hunting for advancement in their portfolio may well want to contemplate the prospective customers of a corporation just before getting its shares. Purchasing a good company with a sturdy outlook at a low-priced cost is often a good investment, so let’s also acquire a glance at the company’s upcoming expectations. Franchise Group’s earnings in excess of the upcoming few yrs are predicted to raise by 66{194d821e0dc8d10be69d2d4a52551aeafc2dee4011c6c9faa8f16ae7103581f6}, indicating a really optimistic foreseeable future ahead. This ought to direct to far more strong cash flows, feeding into a better share value.

What This Usually means For You

Are you a shareholder? It looks like the sector has currently priced in FRG’s positive outlook, with shares buying and selling close to business selling price multiples. Having said that, there are also other crucial things which we have not deemed right now, these types of as the keep track of report of its management crew. Have these things transformed considering that the previous time you looked at FRG? Will you have adequate self esteem to commit in the business really should the rate drop underneath the industry PE ratio?

Are you a prospective investor? If you have been retaining tabs on FRG, now could not be the most best time to purchase, presented it is buying and selling close to industry rate multiples. On the other hand, the optimistic forecast is encouraging for FRG, which implies it’s well worth diving further into other aspects these as the energy of its harmony sheet, in order to acquire benefit of the up coming price fall.

Maintain in mind, when it arrives to analysing a stock it is really worth noting the threats associated. Each firm has challenges, and we’ve spotted 2 warning signs for Franchise Team you need to know about.

If you are no lengthier intrigued in Franchise Group, you can use our no cost platform to see our checklist of more than 50 other stocks with a higher development probable.

Have responses on this write-up? Worried about the information? Get in contact with us directly. Alternatively, e-mail editorial-workforce (at) simplywallst.com.

This short article by Only Wall St is general in character. We supply commentary primarily based on historic knowledge and analyst forecasts only utilizing an impartial methodology and our articles are not meant to be money advice. It does not constitute a recommendation to buy or provide any inventory, and does not acquire account of your targets, or your economical condition. We purpose to convey you long-term concentrated analysis pushed by basic details. Take note that our assessment may possibly not factor in the newest price-delicate firm announcements or qualitative materials. Simply just Wall St has no place in any stocks described.

Be part of A Paid User Investigation Session

You’ll get a US$30 Amazon Gift card for 1 hour of your time whilst assisting us build far better investing instruments for the person traders like your self. Sign up in this article